March 04, 2020

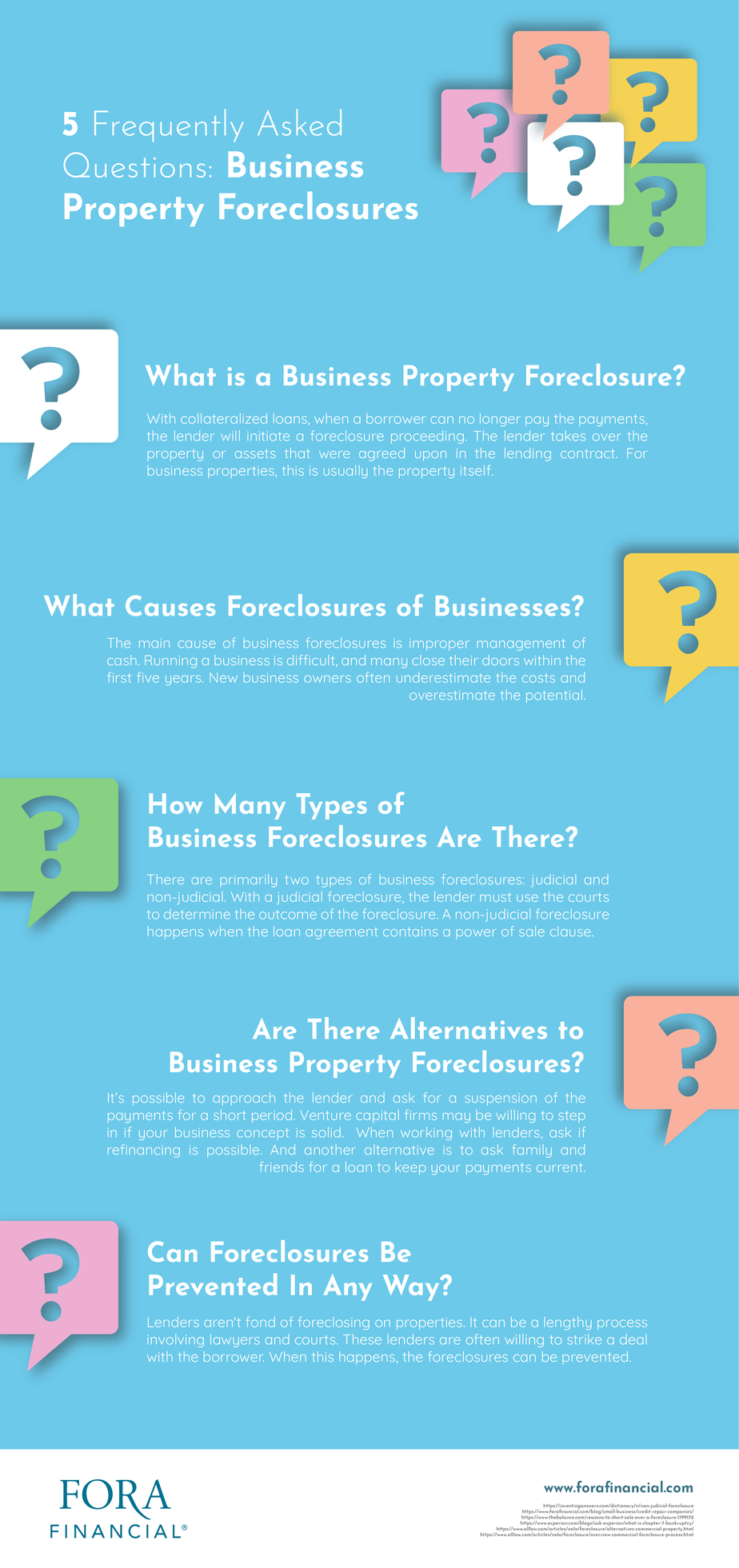

5 Frequently Asked Questions: Business Property Foreclosures

The loans on these properties are mostly secured, which means that collateral is pledged for the assets. When business owners experience losses, they may default on the loans. This could trigger a foreclosure in the business property.

1. What is a Business Property Foreclosure?

With collateralized loans, when a borrower can no longer pay the payments, the lender will initiate a foreclosure proceeding. The lender takes over the property or assets that were agreed upon in the lending contract. For business properties, this is usually the property itself. The foreclosure process is similar for commercial and residential properties. However, commercial properties have further complexities. In many cases, the business owner pledged personal assets in addition to the properties. This can include assets such as the home or cars of the business owner. Depending on the type of business foreclosure, the process may end up in court. Lenders may ask the court to assign a receiver for the property. This entity takes over the management of the property. This is to ensure that the business maintains its value and also can help to collect rent payments on behalf of the lender.2. What Causes Foreclosures of Businesses?

The main cause of business foreclosures is improper management of cash. Running a business is difficult, and many close their doors within the first five years. New business owners often underestimate the costs and overestimate the potential. Even businesses that are well run can experience financial difficulties. A common problem for most businesses is the timing of the production cycles. Extending credit to customers is one of the leading factors of cash flow shortfalls. This credit extension may be a valid action, but it is not without its pitfalls. Businesses that don’t have a detailed business plan can experience money problems. A business plan helps you learn about your industry, including customer demand, competitors, and government restrictions. Many business owners learn the hard way about these forces working against them. A business plan won’t guarantee success, but it increases the likelihood greatly. It can help when seeking funding and may even help when trying to avoid foreclosures. A business plan shows that you're serious about making your business work. Sometimes, business owners focus too much on concept or idea and don’t take action on it. They over plan to the point where the opportunity is missed. Taking no action will guarantee no sales.3. How Many Types of Business Foreclosures Are There?

There are primarily two types of business foreclosures: judicial and non-judicial. With a judicial foreclosure, the lender must use the courts to determine the outcome of the foreclosure. This option is the least desirable by lenders as it can take months or even years to resolve. For the borrower, it buys some time to work out a solution. A non-judicial foreclosure happens when the loan agreement contains a power of sale clause. When this happens, the lender doesn't need the courts to take action against the borrower. This option is one the lenders will favor, as it requires the least amount of processing.4. Are There Alternatives to Business Property Foreclosures?

It’s possible to approach the lender and ask for a suspension of the payments for a short period. If the business owner can convince the lender that future payments for the business will occur, this solution may be acceptable to the lender. Lenders will require most business property owners to pledge a personal guarantee as the property is registered to the business. If this didn’t happen, borrowers could offer this as an option. However, if the business owners cannot pay the loan later, they risk losing the personal assets pledged. Venture capital firms may be willing to step in if your business concept is solid. Due to the distress of the situation, though, they may take a higher percentage equity stake. Angel investors may be willing to step in when venture capital firms are not. When working with lenders, ask if refinancing is possible. Most likely, the terms won't be as favorable, but at least the business can continue as a going concern. Another alternative is to ask family and friends for a loan to keep your payments current. The issue with this option is if you're unable to pay them back. This can cause friction with these parties.

5. Can Foreclosures Be Prevented In Any Way?

Lenders aren't fond of foreclosing on properties. It can be a lengthy process involving lawyers and courts. These lenders are often willing to strike a deal with the borrower. When this happens, the foreclosures can be prevented. The procedure is more formal for a business property than it is for a residential property. The lenders often require a pre-negotiation letter with business property foreclosures. This is an agreement about the term of the negotiation itself. It is used to prevent misunderstandings during negotiations. When your business is faced with foreclosure, it’s best not to wait to take action. Once the foreclosure process is initiated, lawyers get involved, and their charges accrue daily. These fees must be paid by the borrower to reinstate the property. It's possible to negotiate these fees for smaller amounts, but that is not guaranteed. Once the foreclosure notice is issued by the lender, borrowers are given a certain time to make up the payments in default. If you can make the payment before that period of time elapses, you can prevent the foreclosure. The lender may require payment of additional penalties and interest. Some common ways to avoid foreclosure include alternative financing options, loan modifications, surrendering of the commercial property, and bankruptcy. This isn't an exhaustive list but can help you understand some of the options available. The first two are less extreme options. The lender has legal protocols to follow before foreclosing on a property. If the lender doesn't follow the proper procedures, a borrower may have recourse against foreclosure. These situations are rare, but it can be considered a Hail Mary pass for the borrower should they occur.Look For Alternative Financing Options

Other financing options may be available to help keep your business solvent. Analyze your financial statements to see if customers owe you money. If your receivables are growing, ask customers for payment. You can seek out the services of an invoice factor to handle these matters on your behalf. Merchant cash advances are also an option that provides short-term liquidity. The concept involves selling a percentage of your future credit and debit card sales. With both invoice factoring and MCAs, the cash is usually available within days. The costs of these options can be high, however.